As a trader, ensuring you do not fall into a hole of outstanding debt is essential. Knowing and understanding what risk management is in trading and why it is necessary to learn about it. It is pretty essential, and this article is precisely about that.

Risk management is important for a trader to not get into any sort of loss. It is considered a loss if you invest a certain amount of money but lose it through trading. This is why they say that risk management in trading is the key to long-term success.

This article will tell you how to manage the risk while trading, and we will throw in a few tips regarding that, too. Continue lingering around, especially if you are someone who is just dipping their does into this vast sea of trading.

Trading: What Is It?

Buying or selling of shares from companies is what trading is. Share or stock market trading is quite different from the normal trading we are used to. By buying a share, it makes you a shareholder of the company. You will earn money you invested based on the company’s performance.

What Is Metatrader 4?

Forex traders often use an online trading platform called MetaTrader 4. Also, it is known as the platform mt4 for trading. It was developed by a company called MetaQuotes Software and was out for the public to use in 2005.

What Is CFD Trading?

CFD is short for Contract for difference. It is trading but legally bound between an investor and a CFD broker.

Risk Management In Trading

What Is It?

Risk management is observing and recognizing what can cause harm to your investments before they can cause harm to you. It helps you to avoid those patterns and help you move forward with a successful experience in trading.

Plan And Strategize Trades Before Investing

Getting into a trade without knowing about it and your trader is risky. Look into the background of the company or the trader you are investing in– if they have a good history of successful trades in the market, go forward with it. Also, consider doing a technical analysis.

Next, set aside an amount for investing and only use that for doing the same. Do not spend too much so that you do not have to lose much of your hard-earned money all in one place. Make a list of your investments and keep track of their charts every single day.

Think Logically Instead Of Emotionally

If you brought in your emotions, the trading game would have ended before you even started. As a trader, you should welcome your fate no matter what it is. If you face a loss, accept it gracefully instead of whining and not trying again.

You would have suffered this loss because of poor planning or unforeseen circumstances for the company, leading their stocks to go down. You profit from a share, claim it, and do not wait for more. If you stay wanting more, you will suffer a loss.

Thinking about your trades, keeping logic in mind, is better than viewing through a personal or an emotional lens. Losses and gains are pretty common in the world of trading.

Learn And Educate Yourself

Understand and be aware of your trade, what trading is, and what the forex market is. You have numerous materials you can find online to learn about online trading. You must know what risks you are taking.

Educate yourself and learn about the risks you will likely face while trading. Managing risk is very efficiently used by traders when it comes to trading. They get successful because they are the ones who know a lot because of their knowledge of the trade.

Pick A Good Trading Platform

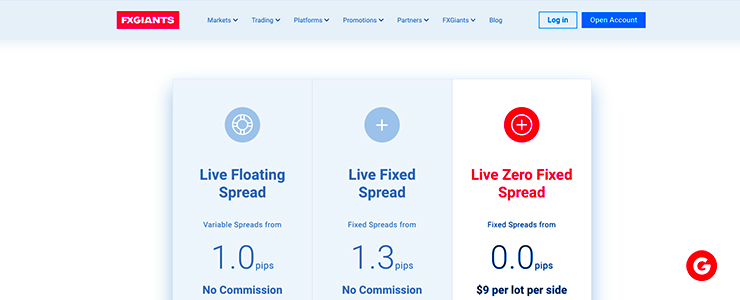

This is essential. Research and choose a good and efficient platform for trade. We suggest you use the FXGiants trading platform; it is user and beginner-friendly and is the best platform for trading. You can perform all sorts of trading here, from CFD to forex trading.

Experience

A good trader is a person who has recognized and understood the patterns of trading’s gains and losses. They know when to enter and get out of the market because they have been through all the highs and lows that come with a journey in trading.

These traders have taken their time to learn about the market and trading and know how things work. They know various strategies they use while they trade, which is why they see so much success in trading.

Set Realistic Goals And Expectations

Trading more doesn’t earn more; it means you are bound to have more losses. Set goals that match the money you invest in the trade and expect realistic outcomes. If a market goes down, it will go down until changes occur. Don’t expect a failing market to bring you profits almost immediately.

Patience

As much as risk management in trading is key, so is patience. Do not expect immediate profits. This ties back to having realistic expectations and goals– if you don’t expect a lot, you won’t be disappointed with your results.

FAQs

Q: Why is managing your risks important when it comes to trading?

A: Risk management in trading is critical because it will save you from the heavy losses you may face. Facing a loss is bound to happen while you trade, but this helps you avoid the huge losses you will face.

Q: What is the main rule to follow in trading?

A: The most common rule is the 2%, meaning you should not invest more than 2% of whatever amount you own while you trade. This is also a risk management technique that you can use to save your loss.

Q: What does risk management do?

A: It helps you reduce the money you can lose. You get to trade efficiently and teach your peers about your tricks, motivating you to continue investing.

Q: CFD and Forex trading: How are they different?

A: While they are two subjects, Forex trading is more about economic foreign exchange. CFD leans more on the legal side, directing the trades to go on which side.

Conclusion

This article covered why risk management in trading is done and needed. We have also included a few strategies you can try to make your risk management journey smoother. Continue reading for more!

DISCLAIMER: This information is not considered investment advice or an investment recommendation, but is instead a marketing communication